Budget Planning

10 steps to financial success, Affordable Baby Preparation Guide, Baby Cost-Saving Techniques, Baby Expenses Budget Guide, Baby Financial Planning Tips, Baby Financial Readiness, Baby Financial Strategy, Baby Financial Wellness Strategy, budget plan website, budget planner website, budget planning platform, Budgeting for Baby's Arrival, budgetplanning website, Building Baby's Emergency Fund, Cost of Raising a Baby Planning, Debt-Free Baby Preparation, Essential Baby Financial Planning, Financial Checklist for Expecting Parents, Financial Planning for New Parents, Handling Baby Costs Wisely, High-Impact Baby Budgeting Tips, Manage Baby Expenses Effectively, New Parent Money Management, Planning Baby Costs Smartly, Preparing for Baby Financially, Saving Money on Baby Essentials

info@budgetplan.website

0 Comments

How to Prepare Financially for a Baby

How to Prepare Financially for a Baby

Welcoming a baby into your life is an exciting journey filled with joy and anticipation. However, it also brings new financial responsibilities that can feel overwhelming without proper planning. Preparing financially for a baby involves strategic planning and budgeting to ensure that you can comfortably meet your new family member’s needs. Here is a comprehensive guide to help you prepare financially for this life-changing event.

1. Assess Your Current Financial Situation

Understand Your Financial Standing

Start by conducting a thorough review of your financial status. Analyze your income, savings, expenses, debts, and investments. Understanding where you currently stand will help identify areas where adjustments are necessary.

Create a Household Budget

Organize your finances by creating a detailed budget. Consider both fixed expenses (such as rent or mortgage, utilities, and insurance) and variable expenses (like groceries and entertainment). This will assist you in managing monthly cash flow and identifying potential savings.

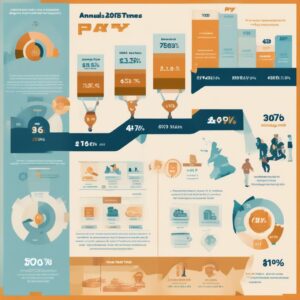

2. Estimate Baby-Related Expenses

Anticipate Initial Costs

Babies require a multitude of items, ranging from crib and stroller to diapers and clothing. It’s essential to list all these initial expenses. Many parents find it helpful to use online tools or checklists to ensure they don’t overlook essential items.

Ongoing Monthly Costs

Consider ongoing costs, including child care, health care, and increased utility bills. Infant-formula, baby food, and diaper costs add up quickly, making it crucial to plan for these recurring expenses.

Healthcare and Insurance

Review your health insurance policy to understand what maternity and pediatric services are covered. Consider increasing your insurance coverage if necessary, as prenatal, labor, and newborn care can be expensive.

3. Build an Emergency Fund

Secure a Financial Safety Net

Building an emergency fund is critical when planning for a baby. Aim to save at least three to six months’ worth of living expenses. This fund will serve as a financial buffer for unexpected expenses, such as medical emergencies or sudden job loss.

4. Consider Parental Leave Options

Understand Your Benefits

Research your employer’s parental leave policy and understand how it affects your income. If your company offers paid leave, calculate how much you will receive. If not, plan for unpaid time off and adjust your savings strategy accordingly.

Government Assistance

Investigate government programs that provide financial assistance to new parents. In the U.S., programs like the Family Medical Leave Act (FMLA) allow eligible employees to take unpaid, job-protected leave for specified family and medical reasons.

5. Reduce Debt

Focus on Debt Repayment

Reducing debt before your baby arrives can free up more of your budget for baby-related expenses. Focus on paying down high-interest debt, such as credit cards, to reduce your financial burden.

6. Future Financial Planning

Start a College Fund

Although it might seem early, starting a college savings fund now, like a 529 plan, can yield significant long-term benefits. Consider setting aside a small amount each month to grow over time through compound interest.

Life Insurance and Will Preparation

Consider obtaining or upgrading life insurance to ensure your family’s financial security. Additionally, prepare or update your will to designate guardianship and manage the future distribution of assets.

7. Adopt Money-Saving Habits

Embrace Second-Hand Items

Babies outgrow clothes and toys quickly. Look for quality second-hand items through thrift stores, online marketplaces, or community swap events to save money.

Take Advantage of Discounts

Sign up for baby registries and mailing lists to receive discounts and samples. Coupons and promotions can significantly reduce the cost of baby essentials.

Breastfeeding and Homemade Baby Food

Breastfeeding can provide significant savings compared to formula feeding. Additionally, making your own baby food can be cost-effective and ensures you know exactly what your baby is eating.

Conclusion: Financial Peace of Mind

Financial preparation for a baby involves careful planning and strategic actions. By evaluating your current financial standing, anticipating baby-related costs, building an emergency fund, and planning for the future, you can welcome your new family member without unnecessary financial stress. With these strategies in place, you’ll be better equipped to focus on the excitement and joy of expanding your family.

Post Comment