Budget Planning

Analytical Skills, Business Acumen, Business Performance, Communication Skills, Competitive Edge., Finance Business Partner, Financial Analysis, financial planning, Financial Reporting, financial stability, Forecasting, Industry Trends, Operational Integration, Performance Monitoring, Problem Solving, risk management, Risk Mitigation, Strategic Decision Support, Strategic Guidance, Technical Proficiency

info@budgetplan.website

0 Comments

The Role of a Finance Business Partner: Duties and Skills Needed

The Role of a Finance Business Partner: Duties and Skills Needed

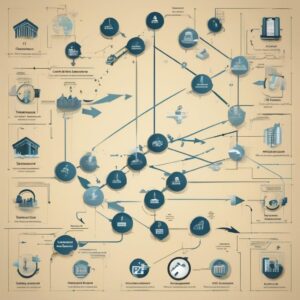

In the complex world of finance planning, the role of a Finance Business Partner is critical to bridging the gap between finance and operations. This role is not just about number crunching; it involves engaging with various business units to provide insights and strategic guidance that helps drive business performance. As businesses strive to remain competitive and profitable, the demand for skilled Finance Business Partners continues to rise. Let’s dive into the key duties and skills that define this role and make it indispensable.

Key Duties of a Finance Business Partner

1. Financial Analysis and Forecasting

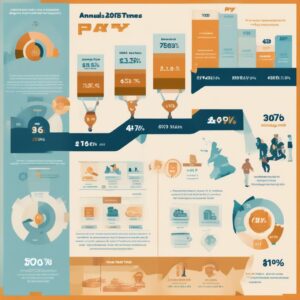

One of the primary duties of a Finance Business Partner is to perform detailed financial analysis and forecasting. This involves analyzing revenue trends, variances, and key performance indicators to provide actionable insights. They collaborate with different departments to gather financial data, which is then used to prepare accurate forecasts and budgets. By doing so, they help the company in making informed financial decisions that align with its strategic goals.

2. Bridging Financial and Operational Functions

Finance Business Partners play a crucial role in connecting the financial team with operational units. They ensure that finance is not siloed and work towards integrating financial considerations into business operations. This involves understanding the operational challenges and translating them into financial terms, thereby helping operational managers understand the financial impact of their decisions. This dual understanding enhances business efficiency and performance.

3. Strategic Decision Support

Another critical aspect of the role is providing strategic decision support. Finance Business Partners work closely with senior management to align financial strategies with overall business objectives. They use their analytical skills to assess business cases, evaluate investment proposals, and support strategic initiatives. Their insights are instrumental in driving strategic changes and achieving long-term goals.

4. Risk Management

In the volatile business landscape, identifying and managing risk is an essential duty. Finance Business Partners identify potential financial risks and work on strategies to mitigate them. This involves assessing market trends, financial health, and potential impacts on the business. By proactively managing risks, they safeguard the company’s financial stability and contribute to sustainable growth.

5. Performance Monitoring and Reporting

Performance monitoring is vital in ensuring that the company’s financial health is on track. Finance Business Partners develop and maintain robust reporting frameworks to track financial performance against budgets and forecasts. They provide timely reports and dashboards that highlight key metrics and variances, enabling the management team to make quick adjustments to strategy as needed.

Essential Skills Needed for a Finance Business Partner

1. Strong Analytical Skills

Analytical skills are at the core of a Finance Business Partner’s role. They must be adept at interpreting complex financial data, spotting trends, and making data-driven recommendations. The ability to analyze various financial scenarios and predict their implications is critical in supporting strategic decision-making and optimizing business performance.

2. Excellent Communication Abilities

A successful Finance Business Partner must possess excellent communication skills to convey complex financial insights clearly and persuasively to non-financial stakeholders. They must tailor their messages to diverse audiences, ensuring that everyone understands the financial implications of their actions. Building strong relationships and fostering open communication channels are essential for effective collaboration.

3. Business Acumen

Having a strong understanding of the business environment and industry trends is crucial. Finance Business Partners need to comprehend the nuances of the various business units they support. This involves recognizing opportunities and threats in the market and applying financial strategies to capitalize on these insights, thereby contributing to the company’s competitiveness.

4. Problem-solving Capabilities

Problem-solving is a significant part of a Finance Business Partner’s role. They must be able to identify issues, analyze potential solutions, and implement effective strategies to address financial challenges. This skill is essential in troubleshooting financial problems and optimizing processes to enhance efficiency and profitability.

5. Technical Proficiency

Proficiency with financial systems and tools is necessary to process and analyze large amounts of data efficiently. Familiarity with financial software, data visualization tools, and enterprise resource planning (ERP) systems enhances a Finance Business Partner’s ability to support their teams effectively. Keeping up with technological advancements in the finance sector is essential to maintain a competitive edge.

Conclusion

The role of a Finance Business Partner is vital to the success of any organization seeking to optimize its finance planning and operational functions. By leveraging their expertise in financial analysis, strategic planning, and effective communication, they provide invaluable insights that drive business performance and growth. As businesses evolve, the importance of skilled Finance Business Partners who can navigate complexities and foster financial success will only continue to grow. By understanding their duties and cultivating the necessary skills, professionals in this role can significantly impact their organizations and further their careers in the dynamic field of finance.

Post Comment