Budget Planning

asset allocation convertible bonds, benefits of convertible bonds, convertible bond ETFs, convertible bond ETFs performance, convertible bond ETFs risks, convertible bond ETFs tax implications, convertible bond market trends, hybrid investment strategy, interest rate sensitivity convertible bonds, investing in convertible bonds UK, portfolio diversification convertible bonds, yield potential convertible bonds

info@budgetplan.website

0 Comments

Convertible Bond ETFs: A Hybrid Investment Strategy for Modern Portfolios

In today’s volatile financial markets, investors continually seek diversified strategies to balance risk and return. Convertible bond ETFs have emerged as a powerful tool, combining the benefits of bonds and equities. This guide explores how UK investors can integrate convertible bond ETFs into their portfolios for optimized performance.

Understanding Convertible Bonds

Convertible bonds are unique debt instruments that offer the holder the right, but not the obligation, to convert the bond into a predetermined number of the issuer’s shares. This blend of debt and equity characteristics provides potential upside similar to stocks while offering downside protection.

What Are Convertible Bond ETFs?

Convertible Bond Exchange-Traded Funds (ETFs) are investment funds that pool capital to invest in a diversified portfolio of convertible bonds. They trade like stocks on an exchange, offering liquidity and flexibility for investors.

Benefits of Investing in Convertible Bond ETFs

Convertible bond ETFs offer the potential for capital appreciation and income generation. They allow investors to benefit from the underlying equity’s growth potential while securing regular interest payments from the bond component.

Historical Performance and Returns

Historically, convertible bonds have demonstrated resilience during market downturns. According to data from Morningstar, convertible bonds have exhibited lower volatility compared to equities, while delivering competitive long-term returns.

Yield Potential in Low-Interest Environments

In low-interest-rate environments, convertible bond ETFs can provide enhanced yield potential compared to traditional fixed-income securities. This makes them attractive for income-focused investors.

Key Components of Convertible Bond ETFs

The composition of a convertible bond ETF typically includes a mix of high-yield and investment-grade convertible securities, offering diversified exposure across sectors and geographies.

Real-Life Example: iShares Convertible Bond ETF

An example of a notable product in this space is the iShares Convertible Bond ETF, which provides diversified exposure to convertible securities globally. Please consult financial advisors for personalized recommendations and disclaimers on specific products.

Evaluating the Conversion Premium

The conversion premium represents the additional price paid by investors to purchase the conversion feature of the bond. Understanding this metric is crucial for evaluating the potential equity upside.

Balancing Risk and Reward

Convertible bonds are less risky than directly investing in equities due to their bond-like characteristics. However, they should be assessed for issuer credit risk and market fluctuations.

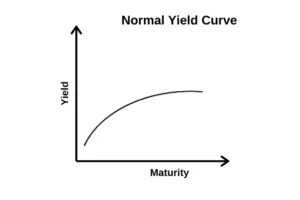

Understanding Interest Rate Sensitivity

These instruments also expose investors to interest rate risks. As with bonds, increasing rates can adversely affect their price. Managing this risk is vital for maintaining portfolio stability.

Asset Allocation and Portfolio Diversification

Incorporating convertible bond ETFs can enhance portfolio diversification. This asset class provides a middle ground between equities and traditional bonds, making it a versatile tool for balancing portfolios.

Analyzing Market Trends and Timing

Successful investing in convertible bond ETFs requires understanding market trends. Monitoring equity performance and bond yield movements helps in making informed decisions about entry and exit timing.

Tax Considerations and Implications

Investors based in the UK should be aware of the tax implications associated with convertible bond ETFs. Depending on the tax treatment of bond interest and equity gains, these investments may provide tax advantages in certain financial structures.

The Future of Convertible Bond ETFs

The demand for convertible bond ETFs continues to grow, driven by their hybrid nature and adaptability. As global markets evolve, these instruments are likely to remain attractive for both conservative and growth-focused investors.

Conclusion: Strategic Insights for UK Investors

Convertible bond ETFs offer a unique opportunity for UK investors to capture the best of both worlds—equity growth and bond income. They are particularly suitable for those seeking diversification, stability, and potential growth in their investment portfolios.

Through careful analysis and strategic implementation, convertible bond ETFs can serve as an integral component of a modern investment strategy, helping investors navigate the complexities of today’s financial landscape.

Disclaimer: This article references iShares Convertible Bond ETF as an example. No endorsement or specific investment advice is implied. Please consult with a licensed financial advisor for personalized guidance.

Post Comment