The Effect of Inflation and Currency Exchange Rates on Financing and Budgeting for UK and US Banks

Understanding the impact of inflation and currency exchange rates is crucial for financial institutions and individual savers alike. In this article, we’ll explore how these economic factors influence financing and budgeting strategies for banks in the UK and US, providing insights that can help both consumers and financial professionals navigate their financial landscapes.

What is Inflation?

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. Central banks, like the Bank of England and the Federal Reserve, monitor inflation closely as it can have significant implications for monetary policy.

How Inflation Affects Budgeting

For banks and financial institutions, inflation can complicate budgeting processes. As the cost of living increases, institutions may need to adjust their projections for operating expenses, salaries, and interest rates.

The Role of Central Banks

Central banks play a pivotal role in managing inflation through monetary policy. In the UK, the Bank of England targets a 2% inflation rate, while in the US, the Federal Reserve aims for a similar goal. Adjustments in interest rates are a common tool used to control inflation.

Understanding Currency Exchange Rates

Currency exchange rates determine how much one currency is worth in terms of another. Fluctuations in these rates can impact international trade, investment, and overall economic stability.

The Impact of Exchange Rates on Financing

For banks engaged in international business, exchange rate volatility can significantly affect financing decisions. A stronger currency may reduce the cost of borrowing in foreign markets, while a weaker currency could raise those costs.

Budgeting for Currency Fluctuations

Financial institutions must account for potential currency fluctuations in their budgets. This includes hedging strategies to mitigate risk, as well as maintaining reserves in multiple currencies to ensure liquidity.

Inflation’s Effect on Loan Demand

Rising inflation can influence consumer behavior regarding loans. As prices increase, individuals may become more reluctant to take on debt, fearing that higher costs will outpace their income. This shift can reduce loan demand, impacting banks’ profitability.

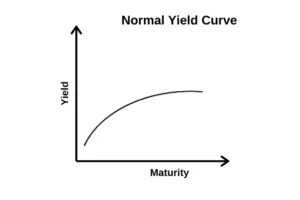

The Relationship Between Inflation and Interest Rates

Interest rates typically rise in response to inflation as central banks attempt to curb spending and stabilize prices. Higher interest rates can increase borrowing costs for consumers and businesses, affecting their financial decisions and budgeting practices.

The Dual Impact of Inflation and Exchange Rates

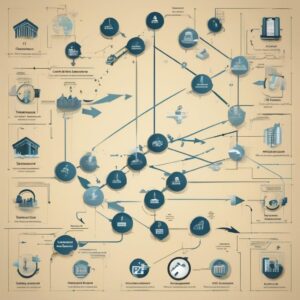

Both inflation and exchange rates can create a complex environment for financial institutions. For example, if inflation rises sharply while the currency weakens, banks may face increased costs for international operations, further complicating their financial strategies.

International Trade and Currency Exchange

For banks involved in international trade, understanding currency exchange rates is vital. Fluctuating rates can affect the profitability of foreign transactions and impact budgeting decisions, as banks must prepare for potential losses due to unfavorable exchange movements.

Inflation’s Role in Consumer Spending

Inflation can diminish consumer purchasing power, leading to decreased spending. For banks, this means that consumers may opt for more conservative budgeting strategies, reducing their demand for loans and other financial products.

Strategies for Mitigating Inflation Risks

Financial institutions can employ various strategies to mitigate inflation risks, including:

- Diversifying Investments: Spreading investments across different asset classes can help buffer against inflation.

- Adjusting Loan Terms: Offering flexible loan terms can attract borrowers even in an inflationary environment.

- Hedging: Utilizing financial instruments to hedge against inflation and currency fluctuations.

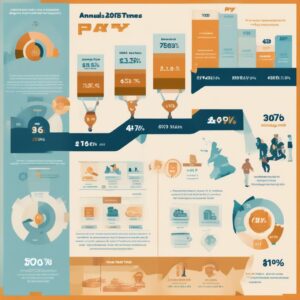

Case Studies: UK vs. US Banks

When examining specific banks, the impact of inflation and currency exchange rates can vary widely. For instance, UK banks might focus more on adjusting interest rates in response to inflation, while US banks may emphasize currency risk management due to their broader international exposure.

The Future of Banking in an Inflationary Environment

As inflation continues to pose challenges, banks must adapt their strategies accordingly. This includes refining their budgeting processes, reassessing risk management strategies, and exploring innovative financing options to better serve consumers.

Conclusion

The interplay between inflation and currency exchange rates significantly influences financing and budgeting for banks in the UK and US. By understanding these dynamics, financial institutions can make more informed decisions that align with their long-term strategies and customer needs.

Post Comment