The Financial Fallout of Wildfires:Preparing for the Unexpected with Expert Financial Strategies

Introduction

Wildfires have devastating impacts, not just on the environment and communities but also on financial stability. Recent disasters, like the 2025 Los Angeles wildfires, highlight the economic vulnerabilities individuals and businesses face in the wake of natural calamities. From property damage to lost income, the financial fallout can be overwhelming. This article explores strategies for preparing for the unexpected and building resilience against wildfire-induced financial crises.

Economic Impact of Wildfires

Wildfires disrupt economies at multiple levels. Key financial consequences include:

- Property Damage: Billions of dollars in damages to homes, businesses, and public infrastructure.

- Loss of Income: Small businesses often close temporarily or permanently, leading to job losses and economic stagnation.

- Insurance Challenges: Rising premiums and coverage exclusions in high-risk areas make financial recovery harder.

- Healthcare Costs: Increased expenses for treating respiratory illnesses caused by wildfire smoke.

Steps to Prepare Financially for Wildfires

1. Build a Robust Emergency Fund

Having an emergency fund with at least 6 months’ worth of living expenses is crucial. This financial cushion can cover immediate needs like relocation, temporary housing, and essential repairs.

2. Review and Update Insurance Policies

Ensure your homeowner’s or renter’s insurance covers wildfire damage. Consider additional coverage for personal property and temporary living expenses.

3. Create a Financial Disaster Recovery Plan

Maintain a detailed inventory of assets, digital backups of important documents, and a step-by-step plan to manage finances during and after a wildfire.

4. Invest in Fire-Resistant Home Improvements

Upgrade your property with fire-resistant materials and implement defensible space measures. While upfront costs may be high, they can significantly reduce potential losses.

5. Diversify Income Streams

Having multiple income sources, such as freelancing or passive investments, can provide financial stability during crises.

Leveraging Financial Aid and Relief Programs

Post-disaster financial aid can be a lifeline for affected individuals and businesses. Here are some resources to consider:

- FEMA Grants: Covers temporary housing, medical expenses, and essential repairs.

- Small Business Administration (SBA) Loans: Low-interest loans for businesses impacted by wildfires.

- Tax Relief Programs: Deduct losses caused by natural disasters from taxable income.

Case Study: The 2025 Los Angeles Wildfires

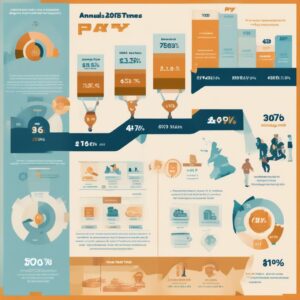

The 2025 wildfires in Los Angeles resulted in over $2 billion in damages, displacing thousands and severely impacting local businesses. However, success stories of resilience emerged as individuals leveraged emergency funds, insurance, and community support to rebuild their lives.

Conclusion

Wildfires are a harsh reminder of the importance of financial preparedness. By adopting proactive strategies like building an emergency fund, securing adequate insurance, and creating a recovery plan, individuals and businesses can mitigate the financial fallout of such disasters. Preparedness is the key to resilience, ensuring that even in the face of adversity, recovery is within reach.

Want more financial tips and insights? Subscribe to our newsletter for expert advice!

Post Comment